Are you planning to start a small business in Florida with a limited budget and shareholders?

The S-Corp status is ideal for your small business. You can take tax advantages of S-Corporation status, however, there are rules and regulations you must follow as well.

Not aware of the process to get an S-corporation status in the Florida State agency. This instruction will help you to know better.

S-Corporation is a tax designation designed by the IRS for which an LLC or a corporation can apply. S-Corp stands for “Subchapter S corporation”, and it is also called a Small Business Corporation.

This status helps businesses avoid double taxation which means their income or losses are passed to the shareholders and reported on their own personal income tax returns. The businesses don’t require to pay taxes at the corporate level. It is called a “pass-through entity”.

S corporation must report their income to the IRS on Form 1120-S every year.

Businesses can apply for an S-Corp status only if they meet the following requirements

- Be a domestic corporation

- Should not have more than 100 shareholders

- Must have only one class of stock

- Should have only restricted shareholders, which may be certain trusts, estates, and individuals.

- Not be an ineligible corporation

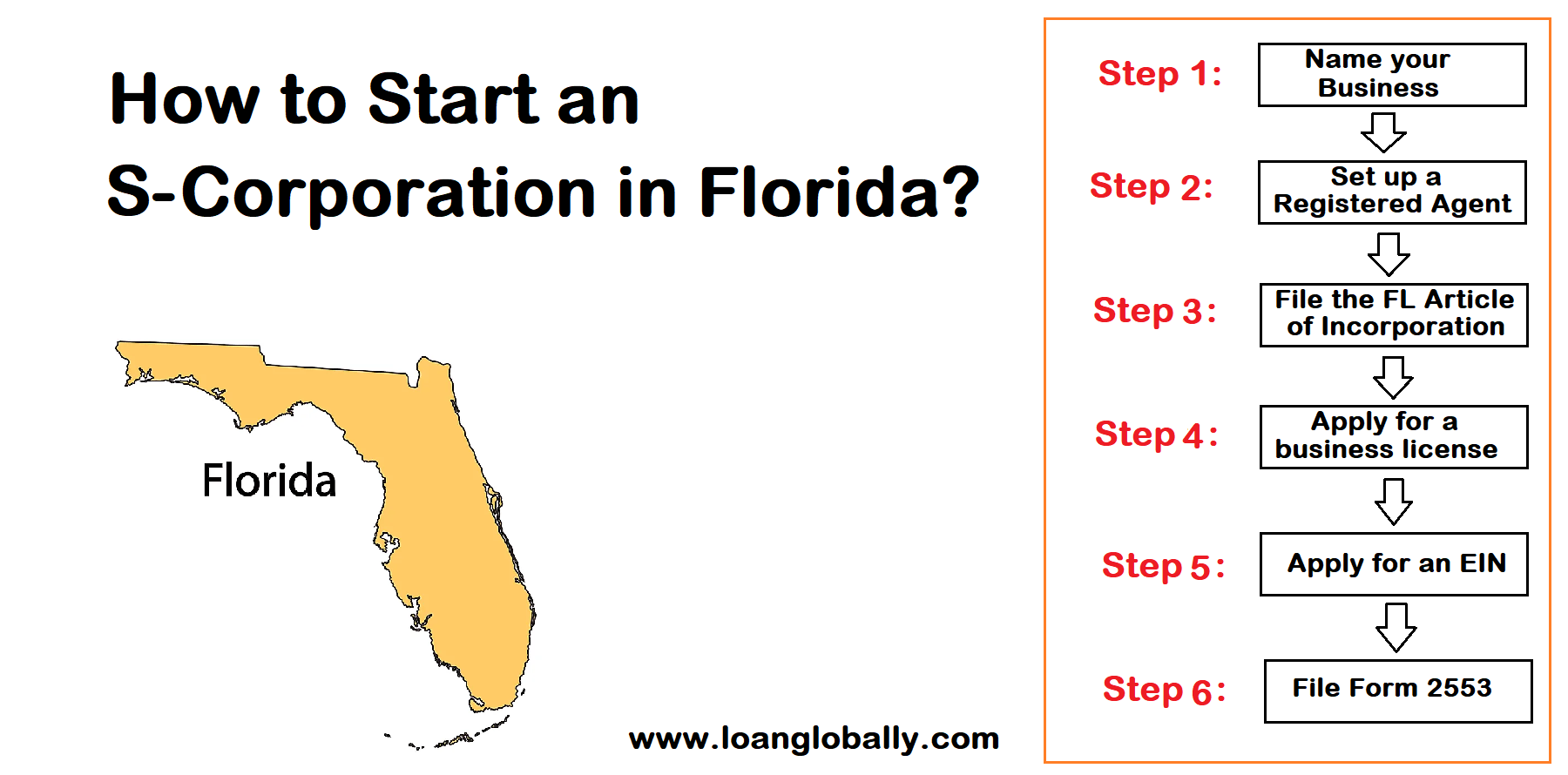

Businesses can apply for the S Corporation status by following the steps:

- Name your business

- Choose a Registered Agent

- File Florida Articles of Incorporation

- Apply for a business license

- Obtain an EIN

- File Form 2253

Herewith explaining each step in detail to apply for S-Corporation Status

This is the first step in registering your business in Florida. The name should convey what you are selling and promote your product.

The business name you choose should not be already registered with the Florida state agency. To check if the business name is available, visit Florida state business entity search.

There are certain rules to be followed in the business name.

- Your business name should include Corporation, Company, Incorporated, LLC, Corp., Inc., or Co.

- Your business name should not be connected with State or Federal Government.

- You shouldn’t use your business name until the name is approved by the Florida Division of Corporations.

Visit the Florida Statutes to know more about naming your business.

You should appoint a registered agent for your business who is responsible person in taking care of legal notices and the registration process in the State of Florida.

The registrant agent should be available at all business hours to not miss any important notices from the State government. It is important to note that they are not legal advisors.

After setting up the registrant agent, you should file your Articles of Incorporation to the Florida State Department.

You’ll need to provide the following information on the Articles of incorporation:

- Basic Information such as Business Name, Address

- Registered agent name, address, & signature

- Business purpose

- Managers and director’s information

- Effective date: This date will be the date the Division of Corporations receives and files your Articles unless you specify an alternative date when you file. This date can be up to 5 days before the date of filing and up to 90 days after you file.

- Stock Shares: You should enter the number of stock shares your business will issue. You must enter at least one stock share to file your Articles of Incorporation.

- Authorized representative signature

Visit https://dos.myflorida.com/sunbiz/start-business/efile/fl-profit-corporation/instructions/ to know more about Filing instructions.

Note: The cost for Filing your article of incorporation is $35.00 and the Registered agent designation fee is $35.00. You can select the certified copy and certificate of status for $8.75 each.

Filing Methods:

You can file the Florida Article of incorporation by Mail or Online.

File Online: If you choose to file electronically, visit here. You can just enter the required data and file to the State department directly.

By Mail: If you choose the paper file option, use the following address:

| Mailing Address |

|---|

| New Filing Section, Department of State, Division of Corporations, P.O. Box 6327, Tallahassee, FL 32314, (850) 245-6052, |

The fourth step is to apply for a business license to start an S corp in Florida. This is the most crucial step in starting a business.

You should work with two main business license agencies to get your business license, either DACS (Department of Agriculture and Consumer Services) or DBPR (Department of Business and Professional Regulation).

The fifth step to starting an S corp in Florida is to apply for an EIN to the IRS. It is free to get your EIN. You can apply for an EIN in three ways, by fax, by mail, or online.

If you apply online, you can receive an EIN immediately, however, it takes some days if you apply it through postal mail or fax.

Visit https://www.irs.gov/businesses/small-businesses-self-employed/how-to-apply-for-an-ein to apply for an EIN.

Once your business (Corporation or LLC) is licenced by the Florida State agency, you need to file Form 2553 with the IRS to get S corporation status.

The final step to starting an S corp in Florida is to complete and submit IRS Form 2553. This form allows a corporation to elect to be treated as an S corp in Florida. After completing IRS Form 2553, you’ll mail or fax it to the IRS.

You must file your Form 2553 within 75 days of the Formation of your corporation or LLC or no more than 75 days after the beginning of the tax year in which the election is to take effect.

If you choose to file your Form 2553 by mail, click here to know the Form 2553 mailing address.

If you start a small business in Florida and looking for an S-Corp status for tax advantages, you must be more aware of the registration process. You must do more research on your own and discuss the process with an experienced accountant before start applying for S-Corp status.