The state of Texas offers several benefits to starting businesses including a low tax burden, Simple state regulations, a large workforce, and more.

If you start a small business in Texas, the S-Corp status is an ideal choice for you. The S-Corp status gives you more advantages for tax purposes.

But, there are several conditions required to know before applying for an S-Corp Status.

What is an S-Corporation?

S-Corps are called pass-through entities which avoid double taxation by passing their income and losses through to their shareholders directly.

The s-corp status helps businesses from paying taxes at the corporate level, rather than the tax that must be paid and reported through the individual income tax return of the shareholders.

Requirements to Apply for an S Corporation Status in Texas

The S Corporation must meet the following IRS requirements before forming a business in Texas.

- Be a domestic corporation

- Should not have more than 100 shareholders

- Should have only one class of stock

- Have only restricted shareholders, which may be certain trusts, estates, and individuals. It may not be corporations, non-resident shareholders, or partnerships.

- Not be an ineligible corporation

S-Corporation status is not a business structure, you must form a corporation or LLC. After that, you can apply for an S-Corporation status.

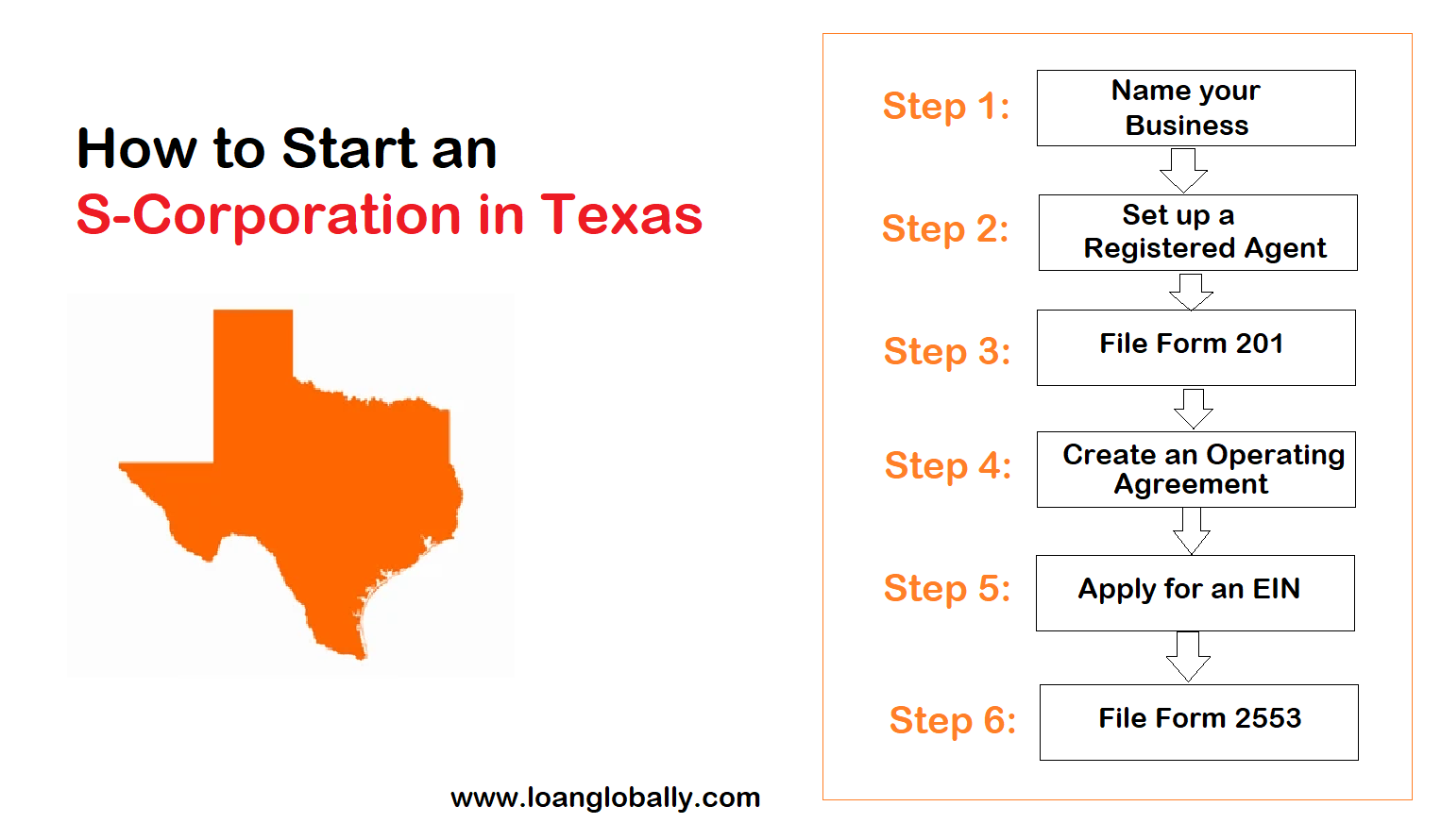

How to Start an S-Corporation in Texas?

There are a few steps you should follow before starting an S-Corp in Texas.

- Name your Business

- Choose a Registered Agent

- File Form 201, Certificate of Formation

- Create an Operating Agreement

- Apply for an EIN

- File Form 2553

Step 1. Name your Business

Before beginning the process of registering your business, you must choose the name for your business and check the availability. It should be unique at the state level.

You can check the availability in the Texas Secretary of State’s SOS Direct Database.

You have the option to reserve it online if you find the business name is available. The state of Texas offers a name reservation fee for 120 days, or name renewal, for $40.

Step 2. Setup Registered Agent for your Business

You must set the Registered Agent for your business to take care of your entire legal process. Registered Agents should be available at the registered office address at all business hours to not miss any notices from the state level.

You can name an individual resident of the state, a Texas corporation, or other entity such as an LLC, limited partnership, partnership, or other legal entity organized under the laws of this state.

Step 3: File Form 201, Texas Certificate of Formation

You must complete Form 201 to start an S-Corporation in Texas. This form is also known as the certificate of formation. To complete it, you’ll need:

- Basic Business details such as name, address

- Business address

- Registered Agent and Office Details

- Directors Details such as name, address

- Shareholders values

- The purpose for which the corporation is formed

- Organizer details such as name, address, and signature

Note: The Fee to file Form 201 is $300.

After completing Form 201, you’ll need to submit it to the Texas Secretary of State. You can submit Form 201 in several ways, by fax, hand delivery, or by mail.

| Mailing Address | Office Address | FAX |

| Secretary of State P.O. Box 13697 Austin, TX 78711-3697 512 463-5555 | James Earl Rudder Office Building 1019 Brazos Austin, TX 78701 | (512) 463-5709 |

Click here to know more about Form 201 filing requirements.

Step 4: Create an Operating Agreement

An operating agreement is a legal document that describes the ownership and member duties of your business.

However this document is not required by the state department, instead, it should be considered a necessary document for your business.

Step 5: Apply for an EIN

The last step to starting an S-Corp in Texas is to obtain your EIN. You can obtain your EIN by completing Form SS-4.

An EIN is a number that is provided by the IRS to identify your business. EINs are free to apply with the IRS.

Step 6: File Form 2553

Once your business is licensed by the State Department and obtained an EIN from the IRS, you can apply for an S-Corp Status by filing Form 2553 to the IRS.

To complete Form 2553, you’ll need:

- Business name, and address

- The date of incorporation

- Your company’s EIN

- Your company’s state of incorporation.

- You must include the address, name, and signature of each shareholder, with the signature and title of a company officer.

After completing Form 2553, you can fax or mail your completed Form 2553 to the IRS. Click here to find the Form 2553 mailing address.

Conclusion:

If you start a small business in Texas and looking for an S-Corp status for tax advantages, you must be more aware of the registration process. You must do more research on your own and discuss the process with an experienced accountant before start applying for S-Corp status.