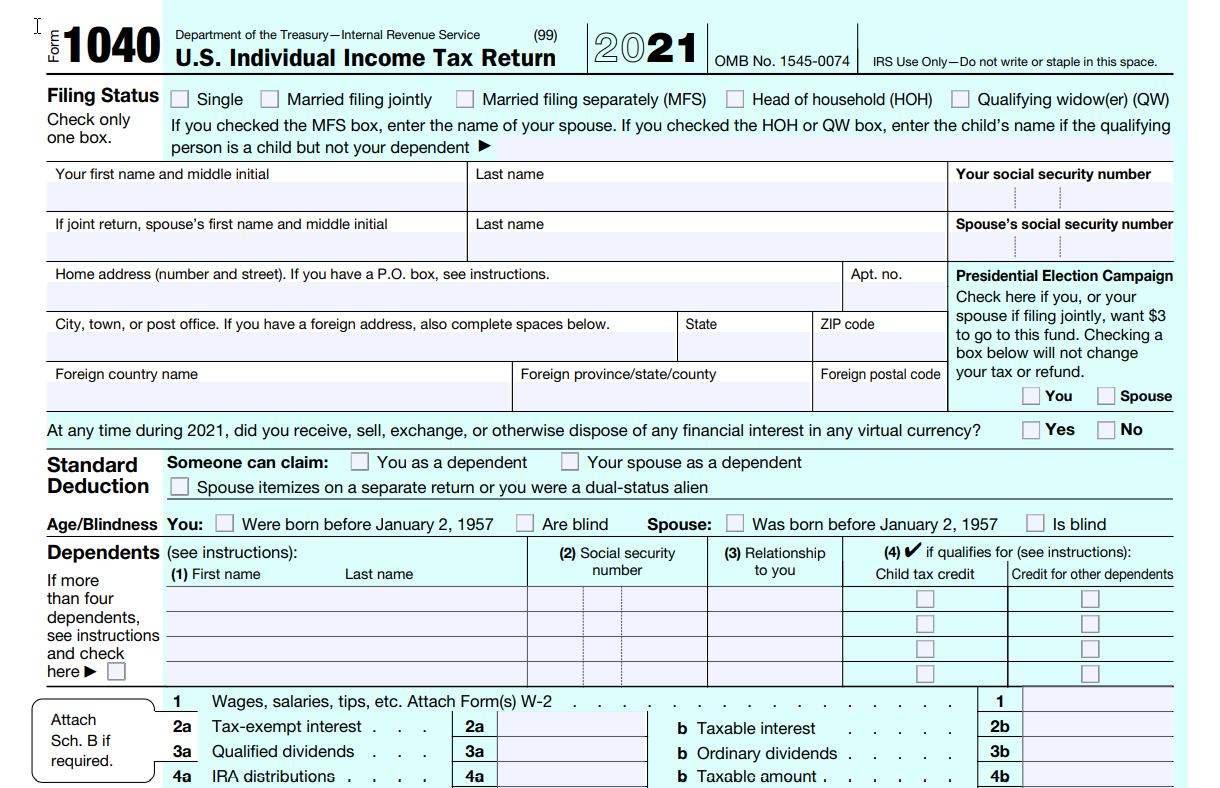

Form 1040 is an IRS tax form used by the U.S. Individuals to report their taxable income for the year. The form helps the IRS determine whether the tax filer will receive a tax refund or additional taxes are owed.

Tax Filers should report Personal information such as name, address, Social Security number, and the number of dependents on Form 1040. Also, tax filers use Form 1040 to report wages, salary, taxable interest, capital gains, pensions, Social Security benefits, and other types of income.

Also, Tax filers may need to file separate attachments with 1040 forms depending on the information provided on the Form 1040.

When is the due date to file Form 1040?

Form 1040 must be filed by April 15. If the due date falls on a Saturday, Sunday, or legal holiday, the due date is on the next business day.

If you were out of the country or serving in the U.S. Armed Forces on the deadline day, the IRS provides an additional 2 months’ automatic extension to file the 1040 Form.

Form 1040 Mailing Address

Form 1040 can be filed electronically or by paper. If you choose to file by paper, prepare the form and mail your return to the following address:

| Location | If you are filing Form 1040 without payment | If you are filing Form 1040 with payment |

| Arkansas ,Connecticut, Delaware, District of Columbia, Illinois, Indiana, Iowa, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, Oklahoma, Rhode Island, Vermont, Virginia, West Virginia, Wisconsin | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Pennsylvania | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P. O. Box 802501 Cincinnati, OH 45280-2501 |

| Florida, Louisiana, Mississippi, Texas | Department of the Treasury Internal Revenue Service Austin, TX 73301-0002 | Internal Revenue Service P.O. Box 1214 Charlotte, NC 28201-1214 |

| Alabama, Georgia, North Carolina, South Carolina, Tennessee | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P O Box 1214 Charlotte, NC 28201-1214 |

| Arizona, New Mexico | Department of the Treasury Internal Revenue Service Austin, TX 73301-0002 | Internal Revenue Service P.O. Box 802501 Cincinnati, OH 45280-2501 |

| Alaska, California, Colorado, Hawaii, Idaho, Kansas, Michigan, Montana, Nebraska, Nevada, Ohio, Oregon, North Dakota, South Dakota, Utah, Washington, Wyoming | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0002 | Internal Revenue Service P O Box 802501 Cincinnati, OH 45280-2501 |

Form 1040 Mailing Address for Non-residents

| Location | If you are filing Form 1040 without payment | If you are filing Form 1040 with payment |

| Outside the United States | Department of the Treasury Internal Revenue Service Austin, TX 73301-0215 USA | Internal Revenue Service P.O. Box 1303 Charlotte, NC 28201-1303 USA |

See irs.gov for more information about this requirement.